Optimism has peaked, according to two widely followed measures of U.S. economic sentiment. If history is any guide, bouts of equity volatility and plunging Treasury yields will soon follow.

The U.S. Citi Economic Surprise index -- the rate at which data exceeds analyst expectations -- has started to fall after reaching a five-year high in December. Meanwhile, the Federal Reserve’s index of the public’s uncertainty about the outlook for monetary policy is climbing after reaching a three-year low in November.

Though the economy remains strong, unbounded enthusiasm has run too far, according to Canaccord Genuity Inc.’s Tony Dwyer. Reality will catch up to interrupt the widespread investor optimism and strong bullish trends imbuing nearly every corner of financial markets, he said.

“We are not suggesting the data is going to get weak, just that expectations have become overly aggressive relative to what is likely to come out,” the equity strategist wrote in a note to clients this week.

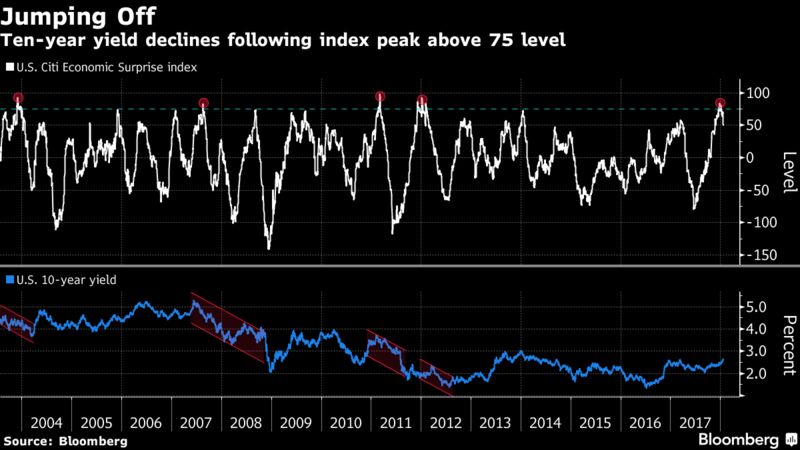

December was only the fifth time since 2003 the economic-surprise index peaked above 75. From each peak to the corresponding trough, 10-year yields on average dropped 1.11 percentage points over the next seven months, according to data compiled by Canaccord. Bonds have yet to respond to recent disappointing data, as the 10-year approaches the 2.66 percent high watermark set in 2014.

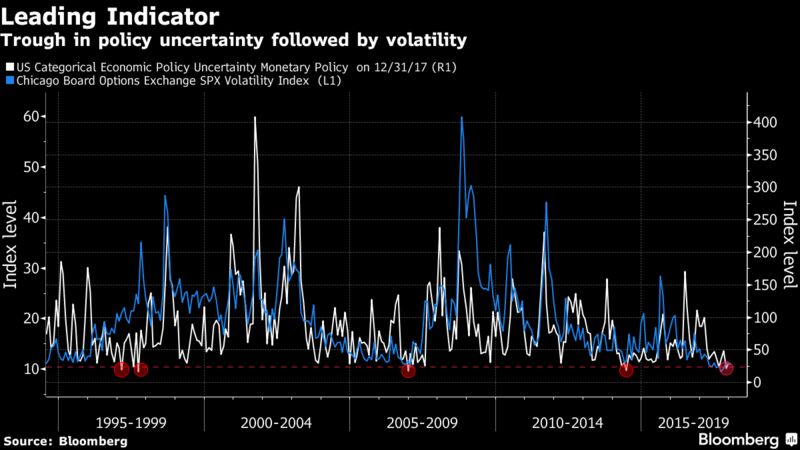

The Monetary Policy Uncertainty index -- which measures angst around the Fed’s moves as recorded in news articles -- has enjoyed consistent weak inflation readings that set the stage for reliably accommodative policy. In fact, there have only been four other times on record when the public was this confident in Fed policy.

Yet in the past, after similar lows came “periods that were associated with more volatility and drawdowns,” said Dwyer, who added that the effect was often temporary. When factoring in the consequences of tax cuts and increasingly hawkish policy from other central banks, uncertainly is likely to increase, fueling volatility in U.S. stocks, he said.

More From this publisher : HERE ; This post was curated using : TrendingTraffic

=>

***********************************************

Read More Here: Markets Are About to Get Ugly According to These Charts

************************************

=>

Sponsored by AMA News

=>

This article was searched, compiled, delivered and presented using RSS Masher & TrendingTraffic

=>>

Markets Are About to Get Ugly According to These Charts was originally posted by Viral News Feed 14

No comments:

Post a Comment